TES are a trusted partner – I’ve worked with our CSM for about 23 years now! TES do as they say, and they deliver.

Ian Knight

CIO

PP Control & Automation

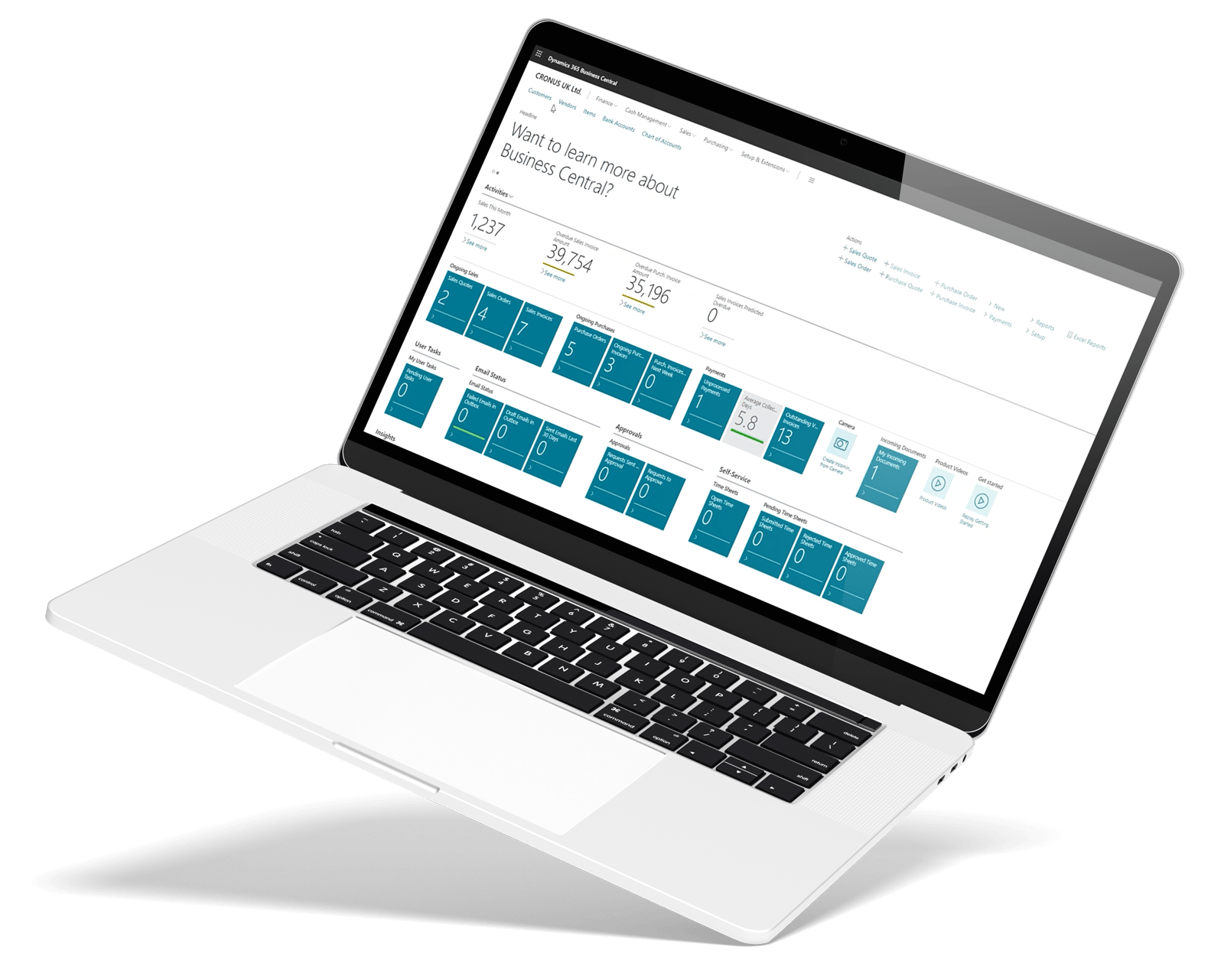

Microsoft Dynamics 365 Business Central (BC) is Microsoft’s market leading business management solution for small to medium sized organisations – typically those with less than 1,000 finance users. Microsoft’s Business Central is used by over 160,000 companies around the world, and is available in 47 different languages; there are over 6,000 users in the UK charity sector alone. It is a cloud-based Software as a Service (SAAS) solution, hosted on Microsoft’s Azure platform and fully integrated into Office 365 and other Dynamics 365 solutions, providing a one-stop-shop for charities and not-for-profit organisations who wish to replace their current business management solution.

Business Central incorporates a broad suite of functionality including Financial Management, Reporting and Analysis, Cash Management, Sales and Purchase Management, Project Management, Fixed Assets and Service Management amongst other features.

Hosted on Microsoft’s Azure platform, this solution provides maximum security, availability and scalability, which is all managed by Microsoft with no need for in-house servers or IT teams. TES then uses BC’s Development Framework to extend and enhance its functionality, based on our many years’ experience in the charity and not-for-profit sectors.

TES’ breadth of experience in implementing Business Central means we are at hand to guide your organisation to where it needs to be. Team TES will train you on how to get the most out of Business Central, and when instructed, TES will implement long-term maintenance and training on the solution.

Whether you’d like to arrange an informal chat, a free demo or discuss a potential project, our team of charity and not-for-profit digital transformation experts are always on hand. Call us on 0345 257 1173, email enquiries@totalenterprisesolutions.co.uk, or fill in our form to get in touch.

The benefits to a finance user are all-encompassing. The Accountant Role Centre provides a complete view of your most important metrics and activities. Enter invoices, run payments, and bank reconciliation, payment registration and see in-system budgets, all in one convenient place.

Ease of management is key for finance users so automated audit trails, multi-entity budgeting, and automated payment schedules will ease the burden of tracking and reporting.

Business Central will accommodate your most complex reports, and TES will take long-term maintenance and training into consideration when instructed to implement the solution on your behalf.

Reporting functionality in Business Central includes important alert features that keep track of the metrics most useful to your finance team, with the ability to notify in real-time. Most users want to see charts and graphs and visualisation options that bring data to life in easy to view and understand depictions.

Business Central will automate all of this for you and consolidate views in user-friendly dashboards.

Microsoft Dynamics 365 Business Central allows organisations like yours to embrace digitalisation. So many organisations are limited by systems that simply don’t allow for change. By implementing Business Central, your organisation is safe in the knowledge that Microsoft is hosting and maintaining the infrastructure and backups of the system, making on-premises upgrades and maintenance a thing of the past.

Based in the cloud, Business Central can connect seamlessly with other Microsoft products. Business Central unifies all assets into a single solution, bringing together the productivity of Microsoft Office 365, and the data connectivity and business intelligence of the Microsoft Power Platform.

Adapt faster, work smarter and perform better. Connect people, processes, and insights. Make better informed decisions. Microsoft Dynamics 365 Business Central is an adaptable solution that grows with you.

Business Central allows users to add other capabilities that your organisation deems functionally adjacent to finance and budget. TES is continuously building on the capability of the solution with useful add-ons for things such as sales forecasting and payroll planning. And Power BI can be used to unlock a world of data visualisation capabilities.

Browse the list below to find add-on applications for Microsoft Dynamics 365 Business Central that are right for you.

By leveraging the unrivalled flexibilities that Business Central natively offers organisations in terms of dimensions, in turn this makes managing your restricted and designated funds easier, whilst improving your ability to report back to donors accurately.

We recognise that for a process that is so important, organisations are often left needing to manage such activities out-of-system with sophisticated spreadsheets and is often treated as a hindrance, rather than a driver. This App allows organisations to accurately reflect their fund usage, without passing the burden to end users who aren’t always necessarily aware of the data required to carry out such activities.

The standard functionality of Business Central does not have a concept of partial VAT recovery against different programmes.

This TES IP enhances standard Business Central so that you can set up partial VAT recovery against GL Accounts and dimensions, and choose what percentage to claim back on your VAT returns. The remainder of the VAT amount can be configured to post back to the expense account where the posting was coded to or a single Expense VAT account in the profit or loss.

Throughout our engagements within the charity and not-for-profit sector, TES acknowledges the real risk of organisations being targeted maliciously, and as such we have created a solution to reduce the risks associated to such attacks.

The Fraud Prevention functionality from TES ensures your suppliers are appropriately vetted before engaging with them. In addition, a full audit trail of the configuration of suppliers is tracked, ensuring your organisation can reduce the risk of malicious attacks.

This TES IP allows the rollout of the finance system to your organisations’ budget holders. By using this functionality your budget holders will be able to monitor the spend against their project budget and enter purchase documents for approval workflow against the cost centre/project.

This can be deployed via the web client, tablet or phone client and is designed for the remote users who do not use a finance system every day and who do not have experience in the organisations’ financial coding structure.

Understanding the nominal nature of charity or not-for-profit organisations’ purchases, we are familiar with the tedious month-end accruals that finance teams endure. Our solution reduces the out-of-system identification of accruals and automatically creates the corresponding journal, maintaining the analysis details so that your data remains accurate.

The automated accruals functionality both reduces the time taken to create and post your accruals, and ensures that interested parties have accurate information when reviewing reports, reducing the time taken on accruals at month-end.

TES’ solution provides organisations with process automation, yet leaves you in control, leaving your finance team with more time to best support the wider organisation in achieving their strategic goals.

We’ve been working with charities and not-for-profits for 20 years. See below for a selection of our third sector partners.

TES is proud of the fantastic feedback that we get on a day-to-day basis from our charity and not-for-profit partners.

Whether you’d like to arrange an informal chat, a free demo or discuss a potential project, our team of charity and not-for-profit digital transformation experts are always on hand.